Top Free 5 No Deposit Casino Bonus Codes For Uk Players

Buffalo Grand Slot Machine

July 17, 2024Best Casino Match Bonuses Biggest Deposit Match Bonuses

July 17, 2024Content

Yorkshire building societyhas cut borrowing rates for customers with a low deposit or equity in their home. It has a two-year fixed rate for home purchase at 6.08percent (was 6.35percent) for borrowers with a 15percent deposit. The equivalent five-year fix for purchase is at 5.59percent (was 5.69percent). It also has a fee-free five-year fixed rate at 5.77percent (was 5.89percent) for remortgage at 90percent LTV. At the same time Virgin has cut fixed rates for purchase, through brokers, with a 1,295 fee by up to 0.16 percentage points – new rates start from 5.23percent.

- Fixed rates for purchase at 95percent loan to value rise by 0.4 percentage points, while deals at 90percent LTV increase by up to 0.3 percentage points.

- Coventry for Intermediaries, the broker arm of Coventry building society, is cutting selected residential rates by up to 23 percentage points.

- HSBChas cut fixed rates on selected residential and buy-to-let mortgage deals by up to 0.3 percentage points, including first-time buyer deals up to 90percent LTV.

- Product transfer two- and five-year fixed rates are increased by 0.4 percentage points.

The rate is market-leading for a two-year fixed rate remortgage, but it requires borrowers to have at least 40percent equity in the property, and there is a 1percent arrangement fee. The bank is offering a two-year fixed rate for home purchase at 4.62percent with a 899 fee. This is available to buyers with at least 40percent cash deposit (60percent loan to value). Among its other new rates the mutual lender will offer a two-year fixed rate, also for home purchase or remortgage at 4.49percent. Both this deal and the new five-year fixed rate are on offer to borrowers with 25percent equity in their home or cash deposit for purchases and there is a 1,495 fee. Mortgage brokers believe today’s slight rise in inflation could prevent the best fixed rate mortgage deals from falling much lower.

June: Fixed Rate Customers Facing Hikes When Deals End

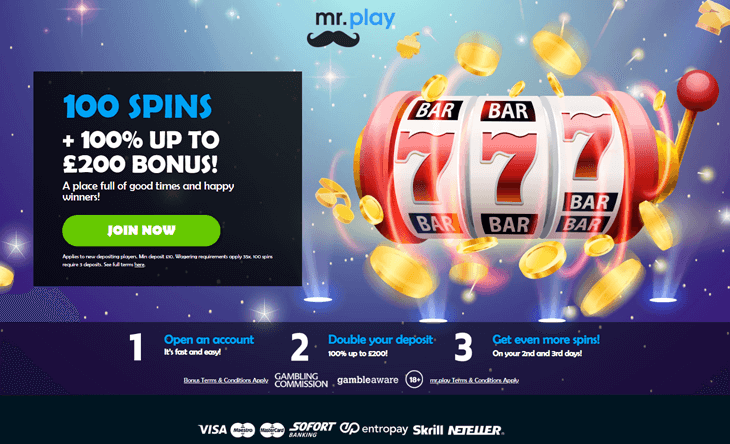

Existing customers can sometimes receive free spins on certain games at the leading mobile casinos too. Our experts work hard https://happy-gambler.com/winpalace-casino/ to uncover all the best no deposit bonus codes on the market, so nothing stays secret from the Casinos.com team. We pass on all the no deposit bonus codes to our readers, so bookmark our guide to stay abreast of all the latest deals. If you require any clarification, you can contact the customer support team 24/7 via live chat at the best online casinos.

Last week NatWest, TSB, Virgin Money and Halifax all lifted their fixed rates. Santander is increasing the cost of its fixed-rate mortgage deals by up to 0.34 percentage points from this evening, which will see an end to its sub-4percent five-year fixed rate deal, writes Jo Thornhill. Costs for the lender’s two-year fixed rate for remortgage now start from 4.69percent with a 1,495 fee (60percent LTV), up from 4.59percent. The equivalent five-year deal has gone up by the same amount to a new rate of 4.3percent. The cost of borrowing for banks in the wholesale markets has been gradually creeping upwards over recent weeks, fuelled by more negative economic news and stubbornly high inflation data. This has increased the likelihood that interest rates, and consequently mortgage rates, will stay higher for longer.

Make sure to read and understand the full terms and conditions of this offer and any other bonuses at Sky Vegas before signing up. By depositing and spending 10, players can claim a further incredible 200 FREE SPINS on top of the 50 free no-deposit spins already credited. Playing at an Online Casino for real money is currently allowed in the States of Pennsylvania, Michigan, New Jersey and West Virginia. For those who are unfamiliar with Multihand Blackjack – you get to play three hands at the same time along with options to place a bonus bet. Wild scatters, multiplier wins, and free bonus rounds are a few of the features that stand out here, including a random progressive jackpot.

Can You Immediately Withdraw Your 5 No Deposit Bonus?

First Direct deals either carry no booking fee or a fee capped at 490. Net approvals for remortgaging also increased from 24,000 in October to 27,000 in November, suggesting resilience in the housing market towards the end of 2023. Net mortgage approvals for house purchases, which is an indicator of future borrowing, rose from 49,300 in November to 50,500 in December. Its current deals, which include a 5-year 3.99percent fix (the only sub-4percent deal remaining on the market) will be pulled at close of business tonight . The cashback – which can total up to 5percent of the home purchase price – will then be used to offset against mortgage interest instead, with the effect of reducing the buyer’s monthly mortgage repayments.

Platform, part of the Co-operative Bank, is cutting fixed rates by up to 0.55 percentage points. It has a two-year fixed rate at 4.2percent (60percent LTV), three-year rates from 4.27percent, five-year rates from 3.9percent and 10-year rates start at 4.05percent. The best five-year fixed rate deals remain below 3.9percent in welcome news for borrowers. The Bank of England Bank Rate is 4.25percent although experts predict it could rise to 4.5percent when the next adjustment is made on 11 May. Swap rates – the rates at which the banks lend to each other – have been nudging upwards in expectation of a rise in the Bank Rate.

Terms and Conditions Applicable On 5 No Deposit Offers

It is offering a fee-free two-year fixed rate for residential borrowers at 5.16percent (90percent LTV). At 60percent LTV, borrowers can get a five-year fix at 4.16percent with a 995 fee. Existing Nationwide borrowers will see increased rates on home mover, shared equity, additional borrowing, green additional borrowing, switcher and switcher additional borrowing products. The switcher five-year fix for existing customers (60percent LTV) is priced at 4.04percent (an increase of 0.1 percentage points) with a 999 fee. The lender is likely to be responding to the recent increase in wholesale swap rates – the interest rates at which the banks lend to each other, which determines how lenders price their fixed rate mortgages. Foundation Home Loans has also cut rates for owner-occupier mortgages by up to 0.1 percentage points.

Santander has increased fixed rates for purchase and remortgage deals for new residential and buy-to-let customers. Specialist buy-to-let lender Lendco has announced it is increasing selected fixed rates in its range including its popular five-year fixed rate, product transfer deals , and some tracker deals. Clydesdale Bank, part of Virgin Money group, has cut selected two- and five-year fixed rate mortgage deals for new and existing customers by up to 0.2 percentage points, effective tomorrow . Among the changes the bank has cut its five-year fixed rate for remortgage at 80percent LTV by 0.1 percentage point to 5.59percent.

Along with a number of banks and building societies, these lenders increased the cost of fixed-rate borrowing for new customers at the end of last month . Its five-year fixed rate deal for remortgage also looks competitive at 4.59percent with a 999 fee (60percent LTV). Its two-year fixed rate for home purchase will now increase from 4.77percent to 4.82percent (60percent LTV) with a 1,495 fee. Its two-year fixed rate for remortgage is now 4.61percent (60percent LTV), down from 4.94percent previously. HSBC is reducing a range of fixed-rate deals for residential and buy-to-let borrowers, both new customers and existing ones looking to switch to a new rate.